B2B (tax excluded) and B2C (tax included) pricing¶

When working with consumers, prices are usually expressed with taxes included in the price (e.g., in most eCommerce). But, when you work in a B2B environment, companies usually negotiate prices with taxes excluded.

Odoo manages both use cases easily, as long as you register your prices on the product with taxes excluded or included, but not both together. If you manage all your prices with tax included (or excluded) only, you can still easily do sales order with a price having taxes excluded (or included): that’s easy.

This documentation is only for the specific use case where you need to have two references for the price (tax included or excluded), for the same product. The reason of the complexity is that there is not a symmetrical relationship with prices included and prices excluded, as shown in this use case, in belgium with a tax of 21%:

Your eCommerce has a product at 10€ (taxes included)

This would do 8.26€ (taxes excluded) and a tax of 1.74€

But for the same use case, if you register the price without taxes on the product form (8.26€), you get a price with tax included at 9.99€, because:

8.26€ * 1.21 = 9.99€

So, depending on how you register your prices on the product form, you will have different results for the price including taxes and the price excluding taxes:

Taxes Excluded: 8.26€ & 10.00€

Taxes Included: 8.26€ & 9.99€

Ghi chú

If you buy 100 pieces at 10€ taxes included, it gets even more tricky. You will get: 1000€ (taxes included) = 826.45€ (price) + 173.55€ (taxes) Which is very different from a price per piece at 8.26€ tax excluded.

This documentation explains how to handle the very specific use case where you need to handle the two prices (tax excluded and included) on the product form within the same company.

Ghi chú

Về mặt tài chính, bạn không có thêm doanh thu khi bán sản phẩm của mình với giá 10€ thay vì 9,99€ (đối với mức thuế 21%), vì doanh thu của bạn sẽ vẫn như ở mức 9,99€, chỉ có điều thuế cao hơn 0,01€. Vì vậy, nếu bạn điều hành một cửa hàng thương mại điện tử tại Bỉ, hãy làm hài lòng khách hàng với mức giá 9,99€ thay vì 10€. Xin lưu ý rằng điều này không áp dụng cho 20€ hoặc 30€, hoặc các mức thuế khác, hoặc số lượng >1. Bạn cũng sẽ làm hài lòng chính mình vì bạn có thể quản lý mọi thứ không bao gồm thuế, điều này giúp giảm lỗi và dễ dàng hơn cho chuyên viên sales của bạn.

Cấu hình¶

Đầu trang¶

Cách tốt nhất để tránh sự phức tạp này là chỉ chọn một cách quản lý giá và tuân thủ theo cách đó: giá chưa bao gồm thuế hoặc giá đã bao gồm thuế. Xác định cách nào là mặc định được lưu trên biểu mẫu sản phẩm (trên thuế mặc định liên quan đến sản phẩm) và để Odoo tự động tính toán cách còn lại, dựa trên bảng giá và vị trí tài chính. Đàm phán hợp đồng của bạn với khách hàng theo cách phù hợp. Cách này hoạt động mượt mà ngay khi cài đặt và bạn không cần phải cấu hình.

If you can not do that and if you really negotiate some prices with tax excluded and, for other customers, others prices with tax included, you must:

always store the default price tax excluded on the product form, and apply a tax (price excluded on the product form)

create a pricelist with prices in tax included, for specific customers

create a fiscal position that switches the tax excluded to a tax included

assign both the pricelist and the fiscal position to customers who want to benefit to this pricelist and fiscal position

For the purpose of this documentation, we will use the above use case:

your product default sale price is 8.26€ tax excluded

but we want to sell it at 10€, tax included, in our shops or eCommerce website

Thương mại điện tử¶

If you only use B2C or B2B prices on your website, simply select the appropriate setting in the Website app settings.

If you have both B2B and B2C prices on a single website, please follow these instructions:

Activate the developer mode and go to .

Open either

Technical / Tax display B2BorTechnical / Tax display B2C.Under the Users tab, add the users requiring access to the price type. Add B2C users in the B2C group and B2B users in the B2B group.

Cài đặt sản phẩm của bạn¶

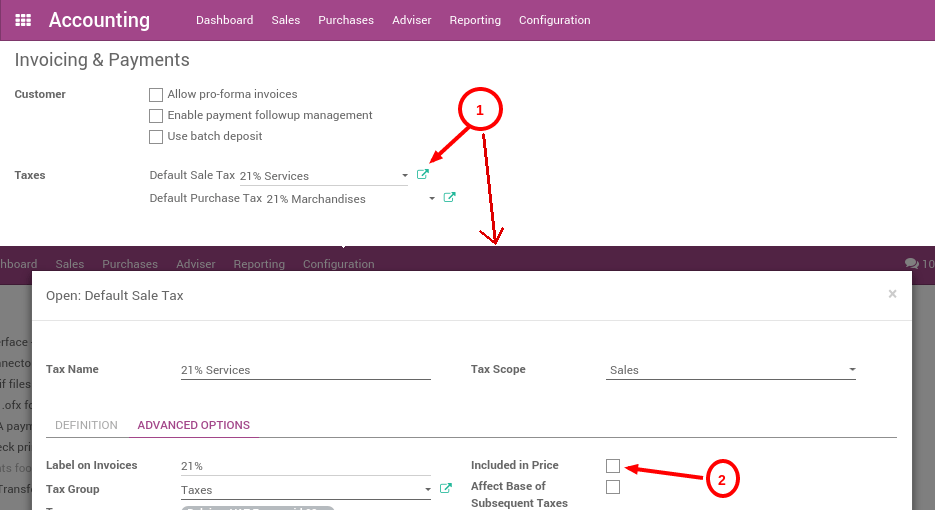

Your company must be configured with tax excluded by default. This is usually the default configuration, but you can check your Default Sale Tax from the menu of the Accounting application.

Once done, you can create a B2C pricelist. You can activate the pricelist feature per customer from the menu: of the Sale application. Choose the option different prices per customer segment.

Once done, create a B2C pricelist from the menu . It’s also good to rename the default pricelist into B2B to avoid confusion.

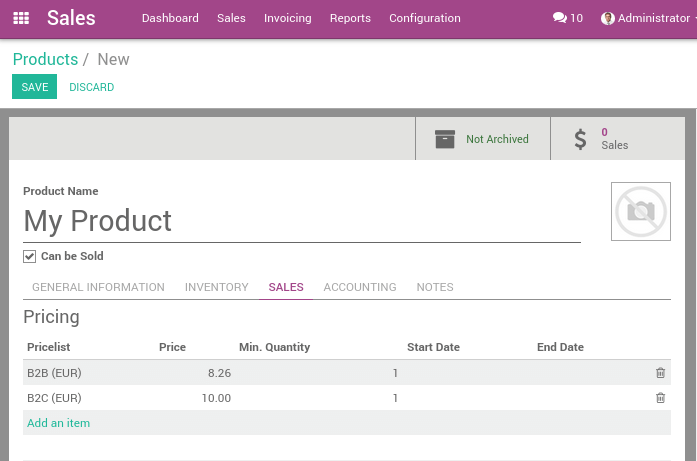

Then, create a product at 8.26€, with a tax of 21% (defined as tax not included in price) and set a price on this product for B2C customers at 10€, from the menu of the Sales application:

Setting the B2C fiscal position¶

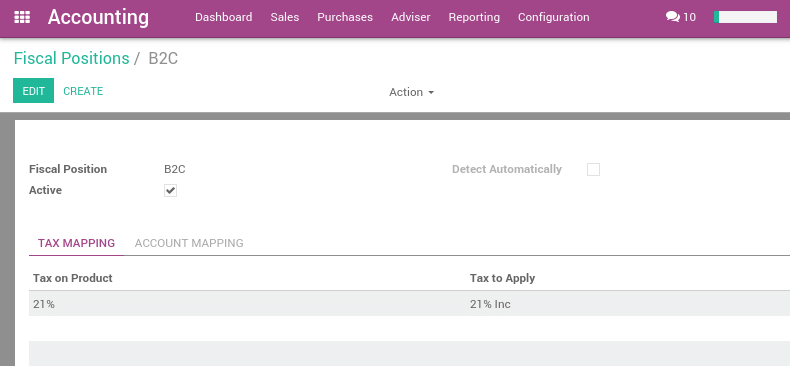

From the accounting application, create a B2C fiscal position from this menu: . This fiscal position should map the VAT 21% (tax excluded of price) with a VAT 21% (tax included in price)

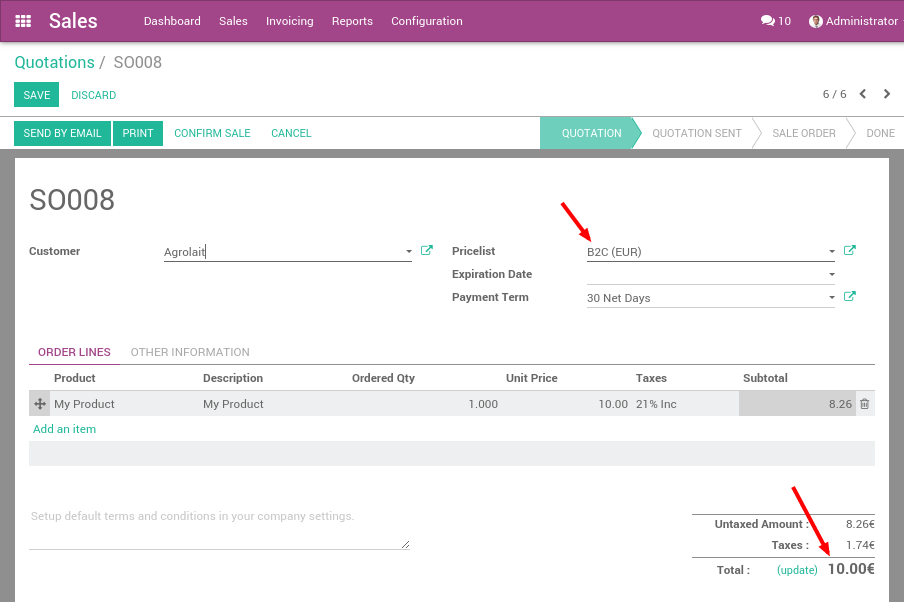

Test by creating a quotation¶

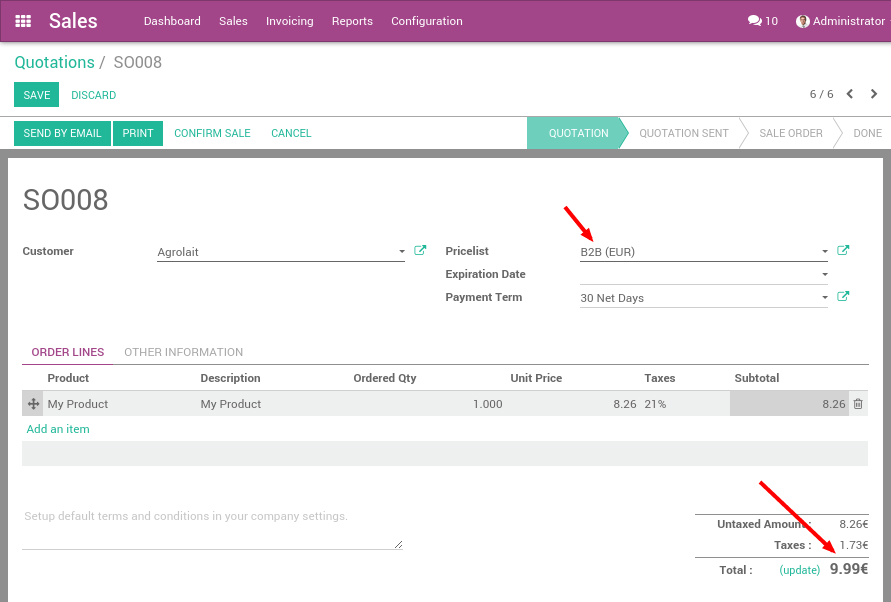

Create a quotation from the Sale application, using the menu. You should have the following result: 8.26€ + 1.73€ = 9.99€.

Then, create a quotation but change the pricelist to B2C and the fiscal position to B2C on the quotation, before adding your product. You should have the expected result, which is a total price of 10€ for the customer: 8.26€ + 1.74€ = 10.00€.

This is the expected behavior for a customer of your shop.

Avoid changing every sale order¶

If you negotiate a contract with a customer, whether you negotiate tax included or tax excluded, you can set the pricelist and the fiscal position on the customer form so that it will be applied automatically at every sale of this customer.

The pricelist is in the Sales & Purchases tab of the customer form, and the fiscal position is in the accounting tab.

Note that this is error prone: if you set a fiscal position with tax included in prices but use a pricelist that is not included, you might have wrong prices calculated for you. That’s why we usually recommend companies to only work with one price reference.